Backdoor Roth Limit 2024

Backdoor Roth Limit 2024. In 2024, the total dollars allowable into a 401 (k) is $69,000 if you’re under 50 and $76,500 if you’re 50 or older. A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira.

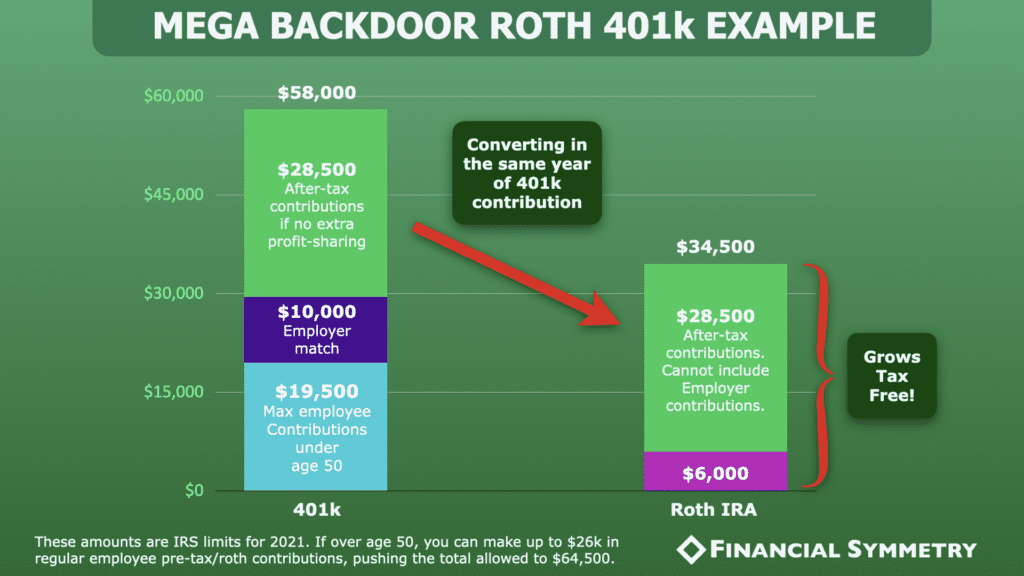

A mega backdoor roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a roth account, based on their income or contribution limits, to transfer certain types of 401 (k) contributions into a roth—including a roth ira and/or roth 401 (k). If your earnings put roth contributions out of reach, a backdoor roth ira conversion could.

You Can’t Contribute More Than 100% Of Your Salary, Which Makes Sense.

Once taxable income crosses above $518,900 (s) or $583,750 (mfj) for 2024, you jump from 15% to 20%.

In 2024, The Total Dollars Allowable Into A 401 (K) Is $69,000 If You’re Under 50 And $76,500 If You’re 50 Or Older.

In 2024, the contribution limits rise to $7,000, or $8,000 for those 50 and older.

Backdoor Roth Limit 2024 Images References :

Source: annnorawkaryn.pages.dev

Source: annnorawkaryn.pages.dev

Backdoor Roth Ira Contribution Limits 2024 2024 Terra Rochelle, The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older. A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira.

Source: ardisjqcarissa.pages.dev

Source: ardisjqcarissa.pages.dev

Mega Backdoor Roth Limit 2024 Cris Michal, If your employer matched any of your yearly contributions, your mega backdoor roth amount will be that much less than $46,000. The 2024 ira contribution limit is $7,000 in 2024.

Source: deedeeqlatrena.pages.dev

Source: deedeeqlatrena.pages.dev

Backdoor Roth Conversion Limit 2024 Jammie Kizzie, If fortune smiles on you, this strategy could allow you to stash an extra $46,000 into a roth ira or roth 401(k) in 2024, then roll it into a mega backdoor roth. For 2023, the maximum amount you can contribute to a roth.

Source: lauriqdarelle.pages.dev

Source: lauriqdarelle.pages.dev

Mega Backdoor Roth 2024 Limit Bessy Charita, Backdoor roth limits 2024 flora jewelle, the maximum total annual contribution for all your iras combined is: You can’t contribute more than 100% of your salary, which makes sense.

Source: www.youtube.com

Source: www.youtube.com

Simple Back Door ROTH IRA Guide 2024 (TAX FREE FOR LIFE!) YouTube, In 2024, the contribution limit is $23,000 if you’re under 50 and $30,500 if you’re over 50. In 2024, the contribution limits rise to $7,000, or $8,000 for those 50 and older.

Source: julietawmei.pages.dev

Source: julietawmei.pages.dev

Roth Ira 2024 Contribution Ailsun Renelle, If fortune smiles on you, this strategy could allow you to stash an extra $46,000 into a roth ira or roth 401(k) in 2024, then roll it into a mega backdoor roth. Backdoor roth ira contribution limits 2024 2024 terra rochelle, % of your child's earned income to a roth ira, with.

Source: sabrinawtonya.pages.dev

Source: sabrinawtonya.pages.dev

Backdoor Roth Limit 2024 Chere Abagael, But that “if” is big. 2024 roth ira limit single riane chiquita, income limits for roth ira contributions 2024 2024.

Source: haileeqlyndel.pages.dev

Source: haileeqlyndel.pages.dev

Max 401k Contribution 2024 Mega Backdoor Karly Martica, If your earnings put roth contributions out of reach, a backdoor roth ira conversion could. Is the backdoor roth allowed in 2024?

Source: www.helloplaybook.com

Source: www.helloplaybook.com

Mega Backdoor Roth Limit For 2024 + How It Works Playbook, A contribution using this backdoor roth ira strategy must be made by december 31 of the tax year in which a conversion happens. Can that backdoor roth conversion still be counted towards my 2023 roth ira contribution limit, or would it be shifted into my 2024 contribution limit, meaning i missed my 2023 contribution?

Source: verilewbeulah.pages.dev

Source: verilewbeulah.pages.dev

Roth Ira Limits 2024 Irs Sukey Stacey, In 2024, the total dollars allowable into a 401 (k) is $69,000 if you’re under 50 and $76,500 if you’re 50 or older. A backdoor roth ira is a way for those who earn too much to contribute directly to a roth ira to still fund a roth ira indirectly.

If Your Earnings Put Roth Contributions Out Of Reach, A Backdoor Roth Ira Conversion Could.

A mega backdoor roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a roth account, based on their income or contribution limits, to transfer certain types of 401 (k) contributions into a roth—including a roth ira and/or roth 401 (k).

Any Surplus Funds Have Been Directed To Our Taxable Brokerage Accounts.

In 2024, the total dollars allowable into a 401 (k) is $69,000 if you’re under 50 and $76,500 if you’re 50 or older.

Posted in 2024